I remember my grandmother talking about “The Old Folk’s Home” on the hill in her little town in Minnesota. She was in her 80s when she called it that- housing for people much more infirm than her; a place she was glad not to be.

Care for the elderly has advanced in many ways in the decades since- but our understanding about facilities now generically called “nursing homes” has not. We still look at these facilities from a distance and dread ever placing our loved ones “up on that hill.”

That dread keeps us uninformed about a real possibility- according to the Centers for Medicare & Medicaid Services (CMS) 45% of Americans will spend at least part of their final years in a long-term care facility, and the cost can be devastating.

What we call “Nursing Homes” are now three distinct levels of care, with different payment calculations. Anyone with an aging relative needs to understand the differences and the implications for their care as well as their family finances.

Aging Within a Family

Let me start by acknowledging that many families absorb their own elderly into their homes and care for them through their entire decline to death. This is the traditional model and a source of pride for many families, as it should be.

There are other families in similar circumstances based less on tradition and more on economics. As you will see, the cost of the options I will review are exorbitant, and beyond the ability of most people to pay. These cases are more unfortunate because there is less choice involved, but the physical and time constraints to care for their elderly are the same, and when that care is good these families deserve even more credit.

However, in our culture, it has become increasingly likely that parents do not live with their children as they age. With no less love these families live in different regions, the children have dual-careers, space in the extended family’s homes is limited and often (and perhaps most importantly) the parents’ wishes and expectations are different from their own parents in the mid-20th century and before.

Rehabilitation Stays and People Opting to Join Retirement Communities

People wind up in facilities at the end of life for a variety of reasons. Some will have a temporary stay for rehabilitation after hip or knee surgery (although that is becoming less common) and return to their own homes. Some will want to downsize and be in a Retirement Community where they have more amenities such as on-site dining rooms, gyms, social interactions and recreational facilities. These are options for people still living independently and are not part of this discussion.

Care at a Skilled Nursing Facility After Hospitalization

As people age, they will almost invariably wind up in a hospital for a surgery or care after a stroke, cardiac event or other illness. In a health care climate that stresses shorter hospital stays, elderly patients are often transferred to Skilled Nursing Facilities (SNFs). Patients in SNFs receive continuing care until they are stable enough to return home (which could be their house, a retirement community or an assisted living facility) or need to be transferred to a nursing home for custodial care (we will get back to that in a minute).

SNFs are regulated by the Department of Health and must meet requirements to be eligible for Medicare and/or Medicaid reimbursement. Although a doctor will not always be on site, care is coordinated with the patient’s physician and under their orders. SNF regulations require a full nursing staff with a percentage of RNs. Most SNFs also have physical therapists, occupational therapists, speech therapists and other health professionals on staff.

Although the length of stay will vary, SNFs are transitional by nature. They are meant as a continuum of hospital care with the goal of either returning the patient to their prior level of independence or shifting them out to a more custodial facility (i.e., a nursing home.)

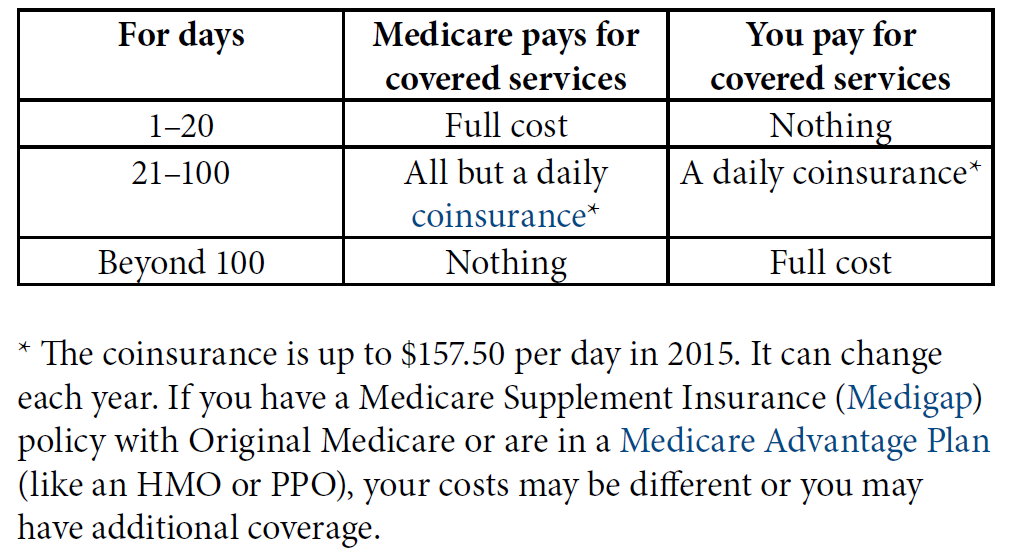

The good news about SNFs- if you or a loved one must go there- is that Medicare will cover at least part of that care, for up to 100 days: [chart resource Medicare.gov ]

The bad news is after you have exhausted your Medicare benefits the cost for a private room in a Skilled Nursing Facility topped $100,000 in 2016, with an average of $102,900 a year (and remember you could pay significantly more depending on your region).

People with Long-Term Health Care Insurance may have the remainder of their SNF expense covered, but then again only 7.2 million Americans carry that type of policy. Every family needs to find out if additional coverage can be obtained through the patient’s supplemental Medicare (Medigap) or private insurance policy (and don’t assume they will!).

When Medicare and insurance benefits run out the cost of the SNF comes out of the patient’s savings. Eventually, they will spend all their money (down to $2,000 in cash and equivalents such as bonds and IRAs) and become Medicaid eligible (62% of people rely on government assistance to the poor to stay in a long-term care facility.)

Many people still believe they can become “poor” (and Medicaid eligible) by transferring their wealth to their children, “but doing so within the five years prior to applying for the program could disqualify them from receiving its benefits.” [citation] Families also need to be aware that Mom or Dad’s house cannot be calculated as an asset for Medicaid purposes, but after their death, the family home can be seized by the government for repayment. With proper legal assistance the house can be protected, but only more than 5 years before Medicaid is needed. (For more, please see this excellent article from U.S. News & World Report.)

When Living at Home is No Longer an Option

Assisted Living begins when people’s level of ability begins to pose safety risks to themselves (and others). Residents commonly can no longer safely operate a stove, drive or negotiate public transportation, properly manage their medications, and be completely independent in caring for themselves. Many Assisted Living facilities will have various levels of support, so people can change their unit as their needs grow.

A relatively new concept 25 years ago, Assisted Living facilities are the fasted-growing sector of the elderly care options, with 31,100 communities available, serving 735,000 people in America. (2018 figures).

The average cost of a one-bedroom apartment in an Assisted Living facility in 2014 was $3,500.00 a month (the price varies significantly across the country). With the likelihood of sighting a Unicorn, there might be an insurance policy that will assist in this cost; most residents furnish this phase of life through the sale of their home and/or out-of-pocket payment.

The average length of living in an Assisted Living facility is 36 months, but this is not a transitional stay before returning home. Presumably, at 36 months the average resident dies, moves to be closer to family, or requires more assistance and transfers into a custodial nursing home.

For people with cognitive and memory issues, there are memory units explicitly designed to protect those people from themselves as well the danger of them moving freely in the outside world. Memory Care is also a fast-growing sector of the elder care industry.

Custodial Care and Nursing Homes

Custodial nursing homes serve the far end of the continuum of care for people who are not tended to by their families and who can no longer live with partial assistance in an Assisted Living Facility (or who have a sudden decrease in ability post-stroke or another catastrophe).

Nursing homes provide “custodial care” which means assistance with “Activities of Daily Living.” There are six daily living activities, which are defined as:

- Eating

- Bathing

- Dressing

- Toileting (being able to get on and off the toilet and perform personal hygiene functions)

- Transferring (being able to get in and out of bed or a chair without assistance)

- Maintaining continence (being able to control bladder and bowel functions)

When a person is no longer able to attend to these basic needs, they are usually admitted to a nursing home.

The staffing at a nursing home will differ from an SNF in that there will be fewer RNs and other higher-level licensed health care professionals; care is predominantly given by Nursing Aids. Federal law requires an RN to be on site at least 8 hours a day, and at least an LPN for the remainder, but does not set staffing level requirements for nurse’s aides. State law may or may not pose additional requirements.

These are the facilities most of us are thinking about when we dread putting our loved ones “away.” To be fair- there are plenty of excellent, caring and clean institutions, but this sector of long-term care has been plagued with problems.

Staffing at nursing homes is chronically a problem– in 2002 a federal study demonstrated inadequate staffing in 9 out of 10 nursing homes. Continuous complaints about the quality of care in nursing homes in America led to a federal quality reporting system through CMS in 2007 although reported staffing levels frequently remained inaccurate. Just this month Kaiser researched staff payroll records (now available because of Obamacare) of more than 14,000 nursing homes and found that the ratio of caregivers to patients was significantly different than what was reported to the government.

Contagious diseases are another chronic problem in these facilities. Violence between residents may lead to significant injury including death- violence against residents at the hands of staff members has been the focus of media attention.

The decision to place a loved-one in custodial care is difficult. We all know that. However, the catastrophic economic consequences are less recognized (again- assuming the patient does not have Long Term Care Insurance).

Probably the biggest surprise for families in this situation is Medicare does not cover this type of long-term care. To put it plainly (as CMS does): “Medicare does not pay for custodial care if it is the only type of care you need.”

And how much will that nursing home care cost? The national median daily rate in 2014 for a private room in a nursing home was $240. At an average stay of 835 days the costs were over $200,000 for the year. (It is challenging to get more recent estimates because resources on the web continually collapse SNFs and custodial nursing homes).

Planning for the Unthinkable

Many aging Americans think they have done an excellent job setting themselves up financially, and their families are comforted by their confidence.

But for that reason families are often caught not only in an emotional upheaval- but a financial one.

It is essential to know more, to investigate resources available in your community or where your loved one resides. Research current insurance policies and find out if long-term facilities and/or custodial care are covered. Pursue financial planning, talk to a lawyer if you want to transfer assets, purchase long-term insurance if you can afford it. These are steps to take today.

Most importantly, talk within your family about how to best plan for an uncertain future. Don’t look at long-term care as something up on the hill- something you can avoid.

Want to Know More:

There are many resources and guides available surrounding this important topic. Here are a few to get you started on your own research:

- Of course, most of us want to age in our home and want the same for our loved ones. If the assistance you need to stay at home is for “Activities of Daily Living” that is not covered by Medicare. For a brochure from CMS on what Medicare will and will not cover for home health care go here.

- A guide on housing options and cost from AARP and a tool to compare prices and types of services in your area, again from AARP, is here.

- An extensive (36 pages) brochure from CMS about Skilled Nursing Facilities, your rights, and further resources is available here.

- Seven Flags to Watch For When Choosing a Nursing Home from U.S. News and World Report here.

- A State by State graph on the breakdown of Medicare, Medicaid and private funding for Certified Nursing Home Care in 2016 from the Kaiser Family Foundation can be downloaded here.