Medicare is Guaranteed Issue- But You Still May Not Get to Choose Your Plan

I started this series months ago, inspired, in part, by family and friends who were surprised that they couldn’t choose traditional Medicare; others reported their retirement plan switched them to a Medicare Advantage policy without their consent (and possibly without their knowledge).

In writing these four installments on the problems with Medicare Advantage, I aimed to provide information so readers approaching 65, retiring later in life, or assisting family members could make an informed choice.

But what if traditional Medicare isn’t an option for everyone? We all know it is “Guarantee Issue;” how could “no choice” be possible?

Medicare is Guarantee Issue- Medigap is Not

A hallmark of Medicare is its availability to everyone on their 65th birthday; you will be accepted even if you are sick, injured, or in poor health. This is called “Guarantee Issue.” (Federal Employees, teachers, and other classes of people may have different retirement benefits, but that is related to their employment, not health, and beyond the scope of this Fontenotes.)

When you reach the age of 65, you are automatically given coverage for hospital care under Medicare Part A. You can add Part B for physician and outpatient Services, and Part D for a drug plan at the same time or later (such as when you or your spouse retires). (See Fontenotes No 122 for a description of the different components of Traditional Medicare.)

However, as also discussed in Part I of this series, there are “gaps” in Medicare coverage, including a Part A deductible for hospitalizations ($1,340 in 2018), a separate deductible for most Part B services ($183), 20% coinsurance for many Part B (physician and outpatient) services, daily copayments for hospitalizations that are longer than 60 days, and daily copays for extended stays in skilled nursing facilities. [Source]

Medigap policies (also called Medicare Supplemental policies) cover those significant out-of-pocket expenses and are crucial if you choose traditional Medicare. You will pay a monthly premium to a private insurance company for this extra policy (See Part I for more explanation).

The alternative to purchasing all the components of Medicare with a Medigap policy is to opt for a Medicare Advantage Plan (see Part II for details). I explain some of the problems with Medicare Advantage in Part III; these deficits in care and coverage are the whole point of this series!

What’s important to know at this point is both traditional Medicare and Medicare Advantage are available to you as Guarantee Issue. You can’t be turned away because of your health or history.

However, that is not true with Medigap policies beyond your first 6-months of eligibility.

Medigap Policies and Guaranteed Issue

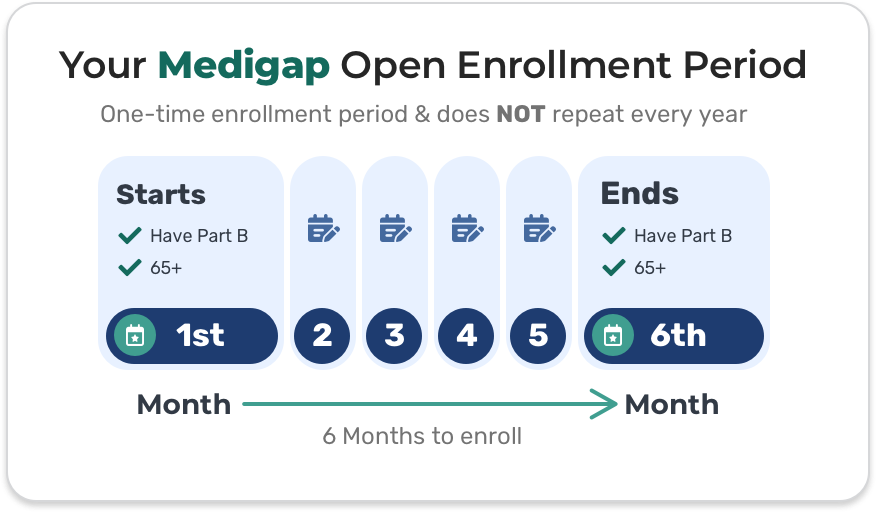

Whether it’s your 65th birthday or later, when you (or your spouse) retire and decide it’s time to pay for Medicare Part B and the other plans you need for full coverage, a 6-month timer starts.

Under Federal Law, everyone has a 6-month “Medigap Open Enrollment” period triggered by your signing up for Medicare B (whether you are 65 or older). This is a One-Time opportunity, as illustrated by Medicare.gov:

During your 6-month open enrollment period:

You can buy any Medigap policy sold in your state. An insurance company can’t use medical underwriting to decide whether to accept your application – they can’t deny you coverage due to pre-existing health problems. [Source, emphasis added]

No underwriting is critical. How many 65-year-olds (or 65+) don’t have some level of cardiac, respiratory, neurologic, or musculoskeletal problems? How many have never had cancer, surgery, or a chronic condition like asthma?

Please Note: there are some exceptions to this 6-month limit (beyond the scope of this Fontenotes), such as your group retirement health plan ending, your insurance company going bankrupt, or your plan moving out of your area. For more information, click here and select “What are guaranteed issue rights?”

Can You Purchase a Medigap Policy After Your 6-Month Open Enrollment Period?

It is a fair guess that most people don’t know they have ONE 6-month opportunity to choose if they want to be in Traditional Medicare or Medicare Advantage.

I also assume many people choose the bells and whistles of Medicare Advantage (see Part II and Part III of this series), believing they can convert to traditional Medicare when they are more likely to need a highly-ranked oncology hospital, physical therapy, or advanced nursing care.

Not so.

You may have extended rights under your state law (more on that in a minute), but most Americans will find they can’t get through underwriting to qualify for the necessary Medigap plan to make that switch (certainly not with a reasonable premium).

Perhaps you are thinking, “Wait! Obamacare got rid of pre-existing condition exclusions!” True. Private insurance practices changed significantly under the 2010 law (for more on the significance of the Affordable Care Act and insurance reform, see Fontenotes No 8.)

Here is the rub. Obamacare protections do not apply to Medigap plans! (Apparently, Congress thought the protections already assured to Medicare beneficiaries were sufficient.)

The States Regulate Private Insurance

Medigap policies are, by definition, plans offered by private insurance companies and are regulated by the states. States can (and do) pass laws that change insurance practices.

Every state will have laws that may extend your ability to purchase a Medigap policy beyond your 6-month grace period. (Go here for examples of Medigap state law variations).

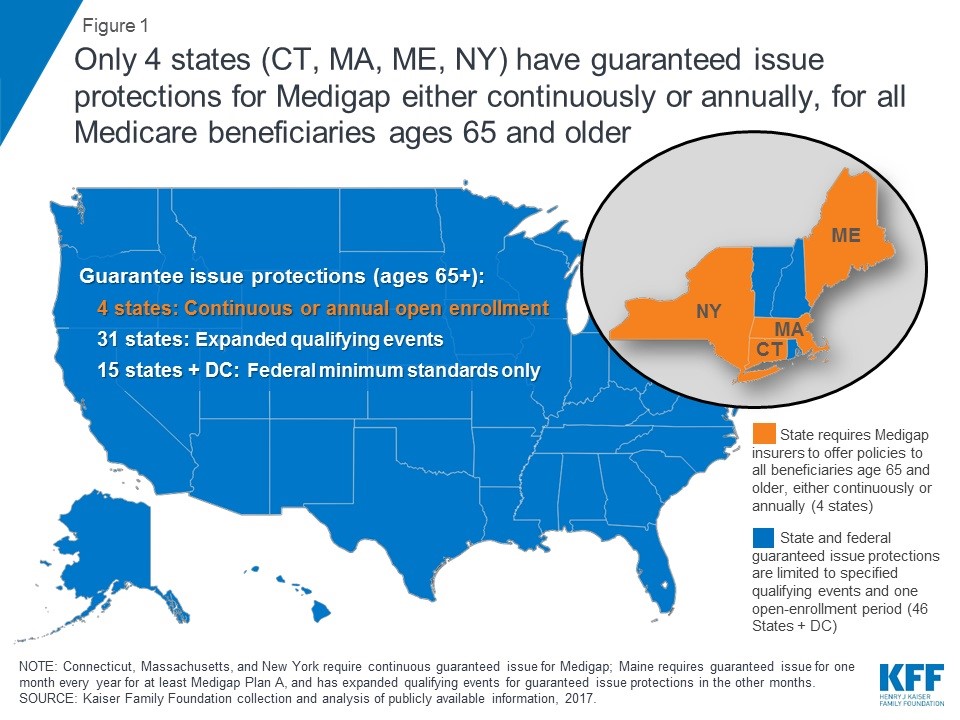

There are, however, only four states (Connecticut, Massachusetts, Maine, and New York) that have laws requiring open access to Medigap policies without underwriting, as shown here:

Opting in and out of traditional Medicare is possible in these four states because Medigap plans are available indefinitely, irrespective of the beneficiary’s health status, history, or age.

The rest of us need to work within the rights we have in our state. An excellent place to start researching what that means for you is through your State Health Insurance Assistance Program [SHIP]. SHIPs “provide local, in-depth, and objective insurance counseling and assistance to Medicare-eligible individuals, their families, and caregivers.” [Source]

The SHIP mission is to empower, educate, and assist Medicare-eligible individuals through objective outreach, counseling, and training.

The SHIP vision is to be the known and trusted community resource for Medicare information. [Source]

Created by the Omnibus Budget Reconciliation Act of 1990, SHIPs are available in every state. To contact your SHIP office, the “Ship Locator” button on this website provides links for every state.

Full Disclosure: I have no personal experience or knowledge about SHIPS. I include them here because (1) they are through government funding and not the private insurance industry, and (2) they are state-specific, i.e., they should be able to tell you about your state guarantee issue rights and other relevant state laws.

How Can Retirement Plans Switch Beneficiaries to Medicare Advantage Policies?

I have heard from many friends that their retirement plan switched them to a Medicare Advantage plan without their consent; all retired from large corporations or educational systems.

I assume the retirement plan administrators made this move because Medicare Advantage “saves money.” Throughout this Fontenotes series, I have pointed to sources that dispute that claim; let me add another excellent source here.

What can I say to my friends upset about being forced onto a Medicare Advantage plan? What does that mean for Guarantee Issue? Can companies do that?

The short answer to this question is “It Depends.” On lots of things. What does the retirement plan contract allow? What rights did you waive when you signed? Is a union involved? What state law controls, and what rights do your state’s laws protect? If your benefit plan tries to switch your coverage, knowing your rights under your state’s Guarantee Issue law could be an essential part of your strategy to fight back.

In the meantime, for any readers with retirement benefits to fill the “gaps” in your Medicare, clarify what type of Medicare you currently have, and read every communication from your retirement plan carefully! (My friends tell me any notice they received about the change to Medicare Advantage was hidden in clever, obtuse language, as was any option to decline.)

I bring up this scenario because it provides a suitable exit ramp for this series; this trend has significant implications for us all.

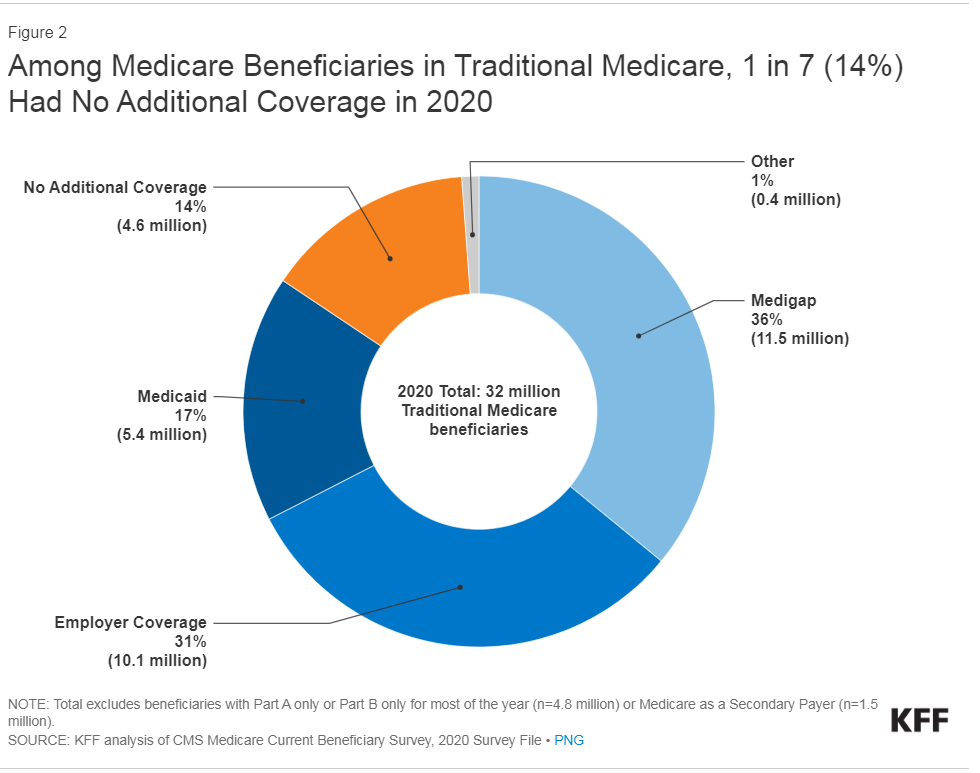

Medicare Advantage has already captured half of the Medicare market (51% in 2023). If large retirement plans adopt that shift, a whopping 31% of beneficiaries currently on traditional Medicare could lose their choice to avoid Medicare Advantage [see graph].

At what point could Traditional Medicare serve so few people it becomes politically possible to discard it entirely?

Conclusion

When I started writing Fontenotes in 2015, Medicare Advantage (Medicare “Part C”) (and all the problems with that alternative to traditional Medicare) was on my list of necessary topics. I knew it would be a long slog to write (and read!), but I didn’t imagine it would take four editions and six months to provide a broad review of this inordinately complicated topic.

And there are still so many more things to know about Medicare! The variety of plans in traditional Medicare, the pros and cons and the expenses of each; any reader choosing a Medicare option needs a licensed, trained guide to help. My aim was to provide background information so you can be an informed consumer of any broker’s services.

Many of you have told me this series has been helpful and that you have forwarded it to friends and family. (Please always feel free to share Fontenotes!)

On the other hand, some readers pushed back- and responded to tell me they were pleased with their Medicare Advantage plan and would never change. I’m glad to hear! It is, after all, your option; just make your choice with open eyes.

Before I close, I want to acknowledge readers who have written to say their finances don’t allow the luxury of a choice and that Medicare Advantage is what fits within their budget constraints. MA plans may not save the government money, but they are often cheaper for the beneficiary. It’s important to acknowledge that; thanks for reminding me.

I wish you all a safe and happy Labor Day and look forward to coming back this Fall to write about anything other than Medicare!

Want to Know More?

- Since we just looked at differences between states on Guaranteed Issue rights, how do they compare on health care access? US News & World Report has an interactive guide providing information on the affordability of health care, the number of wellness and dental visits for adults and children, and health insurance enrollment for every state. Look your state up here.

- Guaranteed Issue is our country’s attempt to globally insure older adults in America. How do our efforts compare internationally? The Commonwealth Fund has a fascinating report comparing the United States to 19