In Part I of this series, I explained traditional Medicare in detail as a guide for readers making coverage decisions and as a prelude to explaining how Medicare Advantage is dramatically different.

I also listed five reasons why I warn people away from Medicare Advantage plans:

- If you get injured or sick, coverage for your care will be subject to standard insurance practices (such as pre-authorization) and will more likely be delayed and/or limited;

- Medicare Advantage Plans have fewer participating physicians and are less likely to cover care from your preferred medical team;

- Delays in payment from Medicare Advantage plans are hurting hospitals, especially in rural America;

- There is a lot of fraud in billing for MA plans. For example, in January, Kaiser exposed “90 previously secret government audits [2011 to 2013] that reveal millions of dollars in overpayments to Medicare Advantage health plans for seniors.”

- Medicare Advantage does not save money as envisioned when President Clinton announced “Medicare Choice” (Medicare Part C) in 1997. For many years it cost taxpayers more money per beneficiary to keep a person on Medicare Advantage than the monthly federal cost for traditional Medicare. To add insult to injury, of those costs under Medicare Part C, a percentage of those federal funds wind up in the pockets of shareholders of private insurance companies instead of paying for care for the patients in their plans.

However, before I can detail my five complaints, I need to delve more into the background of this inordinately confusing subject!

Here are the questions that need answering:

- The Design of Medicare Advantage: How are Insurance Companies Paid?

- How Private Companies Reduce Costs: What is Utilization Management?

- Why was Medicare Advantage Created?

- Medicare Advantage Was Passed 26 Years Ago to Control Costs. Did It Work?

- What’s Driving the Push for Medicare Advantage?

- Fear of “Socialism”

- Skyrocketing Costs

- Profit (How Much Profit is There in Medicare Advantage?)

The Design of Medicare Advantage: How are Insurance Companies Paid?

Advantage plans must include the same coverage as traditional Medicare (Parts A and B); most Advantage plans also include prescription drug coverage (Medicare Part D).

Rather than pay for medical care when needed, as in traditional Medicare (“Fee for Service”), the federal government provides private insurance companies a monthly fee for every beneficiary they enroll in a Medicare Advantage plan. The set per member/per month stipend (the “capitated rate”) pays for any care the beneficiary requires (hospital, physicians, and some drugs included).

The incentive for the insurance company is that any monthly stipend not spent on the beneficiary is a gain (profit that it can then issue to shareholders or spend on other projects).

The Medicare Advantage payment structure promotes less care. “The fixed payment given to private plans provides ‘the potential incentive for insurers to deny access to services and payment in an attempt to increase their profits.’” [quote] (To be fair, given traditional Medicare is a “Fee for Service” model, it patently incentivizes providers to deliver more, even unnecessary, medical care.)

From the beneficiary’s vantage point, choosing Medicare Advantage (or “Medicare C”) means:

- They do not have to purchase part A (they already paid for that through years of Medicare taxes while they or their spouse were working),

- they do have to pay for Medicare Part B (but that payment is less evident to many consumers because it is paid through a withdrawal from their Social Security check), and

- they can avoid paying for Part D and a Supplemental Plan (“Medigap” insurance).

Accordingly, every month, participants in Medicare Advantage have only one active payment to their private party carrier (which may be as low as zero.) (See Part I for an explanation of Medicare parts A, B, C, D, Supplemental plans, and what each Part pays for.)

How Private Companies Reduce Costs: What is Utilization Management?

There are very few cost controls built into traditional Medicare (for more on current efforts to change that, see Want to Know More below).

Private insurance companies, in contrast, have a long history of reducing costs through various industry practices collectively known as “Utilization Management.”

Utilization management is something every reader knows, although they may not know it by name. These are the communications, inquiries, and delays between an order for medical care and the delivery of care we have all experienced. (They are also the insurance business practices that grew in prevalence in the 1980s, leading to the public backlash against “Managed Care” in the 1990s.)

For example, suppose a 50-year-old privately insured patient needs a knee replacement. Permission to have the surgery will involve a review by the patient’s insurance company of the history and severity of the patient’s systems, prior treatments, and the effectiveness of those treatments. Ultimately pre-authorization will allow payment (maybe) for any x-rays and other studies the surgeon wants pre-operatively and then (again, perhaps) pre-authorization of a specific procedure at a particular facility. After surgery, the insurance company will affect what medications will be prescribed, how much will be prescribed, and whether (and where) physical therapy will be part of the plan (and for how long). That’s utilization management.

To describe this in industry terms, utilization management “evaluates the efficiency, appropriateness, and medical necessity of the treatments, services, procedures, and facilities provided to patients on a case-by-case basis. This process is run by — or on behalf of — purchasers of medical services (i.e., insurance providers) rather than by doctors.” (quote, emphasis added)

The types of utilization management that most directly affect patients (and their providers) are:

- “Prospective Review: Performed before or at the onset of treatment, on a case-by-case basis, this review is designed to eliminate unneeded services. The chosen treatment should be considered contingent, and may be changed later.

- Concurrent Review: This type of review occurs during the course of treatment and tracks a patient’s progress and resource consumption; which may cause in-process care procedures to stop.” (source)

Why was Medicare Advantage Created? Bringing Utilization Management to Medicare

Traditional Medicare doesn’t use utilization management processes; the program decides what is “Medically Necessary” by linking certain drugs, treatments, surgeries, etc. to specific diagnoses. As defined by CMS, “Medically Necessary” means “Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.” Payment in traditional Medicare is determined on a more global, less individual basis.

Inspired by the ability of private companies to decrease the cost of medical care, President Clinton created an alternative to traditional Medicare in 1997 with “Medicare Choice” or Medicare Part C (in 2003, “Medicaid Choice” became Medicare Advantage”).

Medicare Advantage didn’t replace traditional Medicare, and the original program couldn’t start acting like a private insurance company. But, with the creation of Medicare C, when a patient opts out of traditional Medicare, the Advantage plan can (and does) implement utilization management screening to minimize the cost of their care. It’s perfectly legal for a private plan to do so.

Medicare Part C Was Passed Twenty-Six Years Ago to Control Costs. Did It Work?

No.

As the cost of caring for the elderly surpassed the capitated rate for Medicare Advantage plans, the companies have negotiated higher rates. (Go here for an explanation of how those capitated rates are determined, and here for a more detailed analysis.)

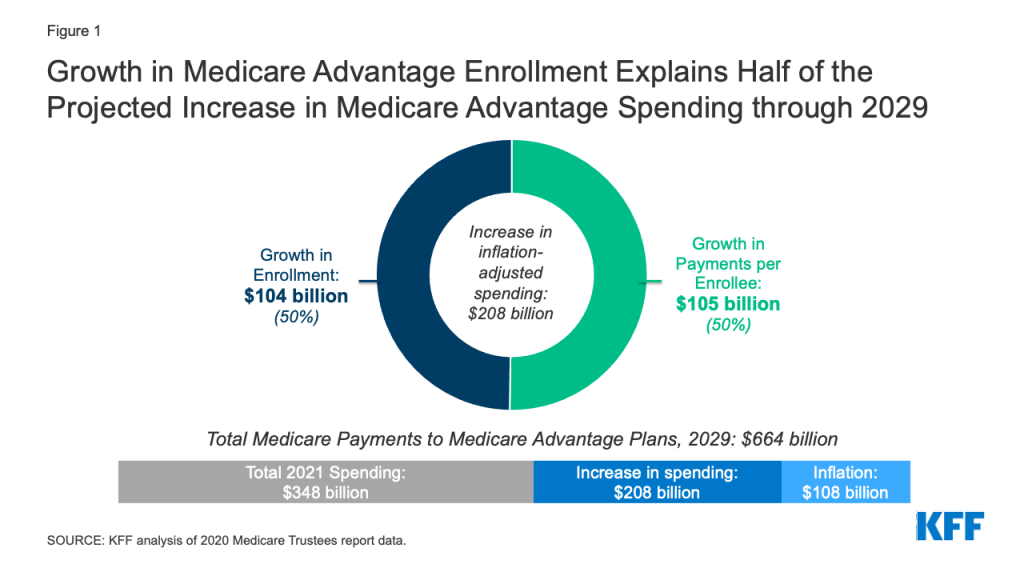

There have been multiple attempts to bring Medicare Advantage “cap rates” down (this was part of the ACA or “ObamaCare”), but as a 2021 study by Kaiser Family Foundation revealed, “Medicare spending is higher and growing faster per person for beneficiaries in Medicare Advantage than in traditional Medicare.”

“Historically, one goal of the Medicare Advantage program was to leverage the efficiencies of managed care [i.e., utilization management] to reduce Medicare spending. However, the program has never generated savings relative to traditional Medicare. In fact, the opposite is true.” [Kaiser Family Foundation, 8/17/21, available here.]

What’s Driving the Push for Medicare Advantage? Fear of “Socialism”

Medicare was signed into law in Independence, Missouri, in 1965 by President Lyndon Johnson, with President Truman by his side. In recognition of the health care protections for the elderly endorsed by Truman during his presidency (1945-1948), immediately after signing, Johnson turned to Truman and made him the first Medicare Beneficiary. (For more on this history, and a great picture, go here.)

Not everyone celebrated the moment. “Medicare was denounced as a sinister government takeover of the nation’s health care system.” [quote] The American Medical Association (AMA) hired actor Ronald Reagan to serve as their spokesperson against “Socialized Medicine” (listen here for an example).

In May 1995, House Speaker Newt Gingrich pledged that under his leadership, Congress “would sharply cut Medicare spending over the next seven years — perhaps by about one-seventh.” (quote) The contest between Gingrich and President Clinton over this budget priority (along with other budget cuts) led to the government shutdown in November 1995 and again from mid-December to early January 1996.

In 2010 Speaker Paul Ryan tried to win similar cuts to Medicare through a voucher program offering beneficiaries a fixed sum for health care rather than an open-ended benefit. (source)

Not all Republicans have fought against Medicare. Ronald Reagan and George H. W. Bush both defended the program during their presidencies. (source) President George W. Bush instituted the most “significant reforms” since the inception of Medicare by adding a prescription drug benefit (“Medicare Part D”). (Forbes published an editorial on the history of the GOP’s relationship with Medicare in 2009, available here.)

However, as recently as 2019, President Donald Trump’s Executive Order titled “Protecting and Improving Medicare for Our Nation’s Seniors” emphasized privatization, “signaling that President Trump envisions an even bigger role for the private sector in Medicare. [quote]

Fear of “Socialism” has driven conservatives to fight against Medicare since the program’s inception; the goal has always been privatizing Medicare. (The word “privatizing” fell out of favor in the George W. Bush years, but make no mistake- Medicare Advantage is privatizing Medicare.) (additional source)

What’s Driving the Push for Medicare Advantage? Skyrocketing Costs

Political ideology is not the only force driving Washington, D.C. away from the Medicare promise made in 1965; fear of skyrocketing costs and insolvency motivates politicians on both sides of the aisle to get the federal government out of insuring the elderly. (In 2002, Medicare spending totaled 10% of the federal budget, as much as Medicaid, the Affordable Care Act, and the Children’s Health Insurance Program [CHIP] combined!)

The question is not if costs in Medicare need to be controlled, but how. Recent changes to tie reimbursement to the quality of services offered to traditional Medicare beneficiaries, rather than the quantity of services, have had some impact (see Want to Know More below.)

In reality, cost-cutting in Medicare is happening on a person-by-person basis, where beneficiaries are being lured into Medicare Advantage by ads that are often misleading.

The push for Medicare Advantage is working. More than 2 million new beneficiaries chose a private Medicare plan in 2022, increasing the program to 45% of all Medicare enrollment. [source]

These people, usually not recognizing the implications of their choice, are siphoned into a program with a set cost to the government (the per member/per month rate), while the insurance company assumes the risk of care exceeding that amount.

What’s Driving the Push for Medicare Advantage? Profit (How Much Profit is There in Medicare Advantage?)

A lot!

Medicare Advantage is the insurance industry’s “hottest” market. According to a Brookings report, the big five Medicare Advantage insurers (UnitedHealthcare, Humana, Aetna, Kaiser Permanente, and Anthem) saw a 4.36% profit margin in 2019. That translates to an average gross profit of $2.3 billion.

But these numbers may be misleading.

In an arena far too complicated for this Fontenotes, larger companies can bundle other service lines as part of their Medicare Advantage plans, include those additions as expenses, and increase their profits while they avoid limiting their profit under the Medical Loss Ratio. For an explanation of the Medical Loss Ratio, see Fontenotes No. 9; for the Brooking report with an in-depth analysis of how companies are increasing profits by working around the MLR, go here. (By the way: Medical Loss Ratio rebates for MA plans are returned to CMS, not to beneficiaries.)

My Concluding Question: What Are You Buying?

Here is all I need readers to recognize: private insurance companies have extensive utilization management systems that reduce choices for patients and their providers. Medicare Advantage plans that limit or deny care keep more of their monthly fee from the government. Care not delivered to a patient = profit to the company.

You might get coverage for vision, dental, hearing, and gym memberships, but those all come out of the same “pool” of money. What’s left for the care you need if/when you become truly sick, injured, or aged?

This is the segue to addressing my top 5 complaints about Medicare Advantage plans.

But not now! I’m sure you are as exhausted reading as I am writing.

I will address each of those 5 concerns in Part III of this Fontenotes series.

Want to Know More?

1. In 2011, CMS announced the Final Rule for the first year of a new program meant to reduce the costs of traditional Medicare. This effort to rein in the costs of traditional Medicare tie reimbursement to quality metrics and other standards, known as “Value Driven Healthcare,” described in this pamphlet here. If you want to know more, here is a summary published by CMS for beneficiaries (and taxpayers). (Go here for an extensive discussion of the evolution of other attempts to reign in traditional Medicare between 1965 and 1997.)

2. What about AARP?

AARP is the best-known advocacy group for Americans over 65 and a source I frequently rely on in my research. But in writing this series about the problems with Medicare Advantage, I saw no arguments or warnings from AARP. Then I found this: “Despite massive and systemic problems with for-profit Medicare plans denying care to seniors while costing the government more than $7 billion annually in excess fees, the leading advocacy group tasked with protecting older Americans is welcoming the privatization of the national health insurance program–while earning as much as $814 million annually from insurers advertising the plans” … ‘The AARP makes money through its own Medicare Advantage plans,’ said Don Berwick, an administrator of Centers for Medicare and Medicaid Services (CMS) in the Obama administration who has emerged as a prominent critic of the program. ‘It would be understandable that it would try to protect one of its major income sources.’” [Monthly Review Online, available here.] That answered the question: “Where is AARP?” for me.